| Afaceri | Agricultura | Economie | Management | Marketing | Protectia muncii |

| Transporturi |

The Real Estate Market

Once the Lehman’s collapse, the entire real estate market took a 180-degree turn, including the local one, due to the financial market deadlock. The residential market slid into a complete resting point, where nobody can sell anything, anymore. The office market, however, remained mildly active. We can still see lease-agreements concluding, but many developers are hesitant on whether they should continue their projects or block them, amid rising financing costs. The only special segment is the industrial one, where products evolve against the trend

The rising market in 2007-early 2008 has changed radically, and the fundamental aspects, such as rents, land prices and constructions changed and keep on changing dramatically.

After rising by as much as 50% y-o-y in 2007, house

prices in some districts of

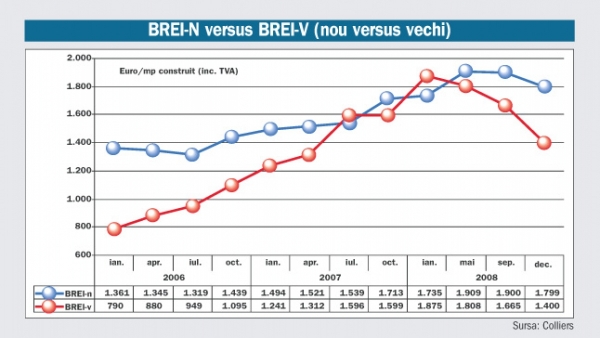

While real estate prices have been constantly rising since 2002, prices of old

apartments in

Demand for Romanian properties rose in anticipation of EU accession in January

2007. A year after, investors were disappointed with the rate promised reforms

are taking place. Corruption is rife and largely ignored (or tolerated) by the

government.

Foreign buying had been enormously important in pushing up house prices, as

Romanian property was a significant bargain in trans-European terms.

Investors who took euro-denominated loans to join the housing boom are now

affected by higher interest rates and the depreciating Romanian new leu (RON).

The ECB raised rates key rates four times from 3% in Sep 2006 to 4% in June

2007, where it remained until now. After appreciating strongly from RON 3.42

per euro in 2004 to RON 3.2 in mid-2007, the currency depreciated to about

RON3.70 in the first quarter of 2008, to 4.2 in January

2009.

The selling price for apartments in the centre of

There are no restrictions on foreign nationals acquiring dwellings, but

ownership of land is a bit tricky. Companies incorporated in

Despite the world real estate crisis, the Romanian market continued to have the most dynamic development within the EU in 2008, a National Prognosis Institute report shows. Thus in the first semester a 33.3 % increase registered with a GDP contribution of 8.1%.

In the first 8 months of the year, the activity of the

sector increased by 31.5% as compared to the similar period, in 2007. Eurostat,

gathering up data from all 27 member states, showed that

An important indicator for the real estate dynamics is the number of authorizations released for the construction of residential houses:

in the first eight months of the year, there were 41,290 authorizations, a 11.2% increase as compared to the similar year in 2007

in August 2008 there were 6,057 authorizations released, with an increase of 3.7% as compared to July 2008

of the total authorizations, 61.7% were for the rural area

The average rent price in

'The rent level had an ascending trend during the past years, with 2008 recording the highest level in the last decade, up to 26 Euros per square meters per month'.

The real estate investments reached 900 million Euros, only 7.7% of it being designed for office buildings, an abrupt fall from the 2007 figures, when the office buildings represented 21.5% of all investments.

Other real estate agencies, like Re/Max Bastion, estimate

that companies will move towards less wide office spaces, with lower costs in

both maintenance and rent. Company consultants say that the average price is

expected to drop between 5 and 10% in some

In 2008 more than 3.750 residential units were finished, the number being double compared to year 2007 (CB Richard Ellis-Eurisko Report). The total sales fell down because of the lack of credits granted by the Banks, and that created o market blockage at the beginning of 2009.

Since September 2008, no credits were being granted for real estate Projects. Furthermore, the projects under construction no monger received credits to finish the estates which determined a negative evolution of the prices. The prices decreased with more than 30%: eg. The prices in Otopeni fell from 1.500 Euros to 900 Euros per sqm.

The number of real estate deals in Romania decreased about 25% on the year in the last four months of 2008 and the number of deals for the entire year 2008 decreased more than 7% compared to 2007, the Romanian Union of Notaries Public, or UNNPR, said in a press release Thursday.

A number 149,679 of real estate deals were closed in September - December 2008, compared to 196,327 in the same period the year before, which translates into a 23.76% decrease.

The downward trend that the realty market started on in September maintained in December as well, when the number of deals reached 33,000 compared to over 50,000 in December 2007, decreasing about 35%.

The biggest decrease was registered in November, when the number of deals was down 54%, compared with slowdowns of 15% registered in September and October.

For the entire year 2008, the number of real estate deals

in

The lower number of deals also had an impact on the collection of taxes notaries public collect. In 2008, taxes from realty deals amounted to 1.048 billion lei (EUR1=RON4.2340), down 12.3% from the RON1.196 billion collected in 2007.

At the beginning of 2008, Romanian notaries estimated tax collections would increase about 30%, based on continued price increases on the real estate market.

Taxes on realty deals range from 1% to 3%, depending on property value and acquisition date.

Moderate yields in

|

May 2008 | |||||

|

|

COST (€) |

YIELD (p.a.) |

PRICE/SQ.M. (€) |

||

|

TO BUY |

MONTHLY RENT |

TO BUY |

MONTHLY RENT |

||

|

75 sq. m. | |||||

|

120 sq. m. | |||||

|

165 sq. m. | |||||

|

250 sq. m. |

| ||||

|

Floreasca, Dorobanti, Unirii,

Rosetti, Romana, Kiseleff, Primaverii, Aviatorilor, Baneasa, Aviatiei, Scoala

Herestrau |

|||||

Gross rental income on apartments in

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Average per square metre (sq. m.) prices in US$/€ of 120-sq. m. apartments located in the centre of the most important city of each country, either the:

Rental income earned by non-residents is taxed at a flat rate of 16%. A fixed

deduction of 25% of the gross income is allowed to account for

income-generating expenses. Taxpayers may also opt for itemized deductions of

all expenses.

A

landlord in

As of 01 January 2008, taxpayers who earn rental income from more than five simultaneous rental contracts can only be taxed under the direct method (gross income less itemized deductible expenses).

Individuals who sell Romanian property are liable to pay transfer tax, levied on the sales proceeds. The applicable tax rate depends on how long the property was held by the owner and how much the actual sales proceeds are.

TRANSFER

TAX FOR PROPERTY

|

|

|

SALES PROCEEDS, RON (€) |

TAX RATE |

|

Up to 200,000 (€56,965) | |

|

Over 200,000 (€56,965) | |

TRANSFER

TAX FOR PROPERTY

|

|

|

SALES PROCEEDS, RON (€) |

TAX RATE |

|

Up to 200,000 (€56,965) | |

|

Over 200,000 (€56,965) | |

VAT is levied on sale of real property. However, this ruling is not applicable to transfers of real estate from a natural person to a legal entity, or for transfers between individuals.

A local tax is levied on buildings, payable by the owner. The applicable tax rate varies between 0.25% and 1%, depending on the building’s location and property value. If the building has not been revalued during the last three years, the applicable tax rate varies from 5% to 10%.

A local

tax is levied on land in

House prices

continued to drop significantly across the country, compounded by the turmoil

of the current financial crisis.

Beleaguered banks continue to charge high interest rates even for customers

with good credit standing and larger equities. This makes acquisition of new

mortgages even harder. An increasing trend of foreclosure properties triggered

this decisive intervention by the government to try and salvage the mortgage

market.

With high rates not expected to come down soon, houses remain idle across the

country.

Home values continue to fall, which experts say may not shift direction until

the later months of next year. This will put investors at risk and might

consider putting their homes up for rent, in a bid to thwart possible

foreclosures.

The only hope in the horizon for these homes would be for bargain hunters to

come and shop for foreclosed homes which may help bring the industry back on

its feet and put prices back to competitive and profitable levels.

BIBLIOGRAFIE

www.realestate.ro;

https://www.sfin.ro/articol_15206/pretul_locuintelor_noi_coboara_si_in_statistici.html;

www.ziua.net/news.php?data=2008-03-19&id=4721;

Real Estate Magazine, nr. 3, 08.01.2009.

www.propeller.com/story/2008/11/12/2009-real-estate-market-is-expected-to-keep-the-bad-trend;

Copyright © 2026 - Toate drepturile rezervate