THE ANALYSIS OF

THE PRESENT ROMANIAN LEASING MARKET

1. Current

structure of the Romanian leasing market

When analyzing the way a market is structured, several

criteria must be taken into consideration. Regarding the leasing market, a

number of elements must be taken into account in order to provide a clear

picture about the situation which is being emphasized.

The structure of the Romanian leasing market can be analyzed

by using the following criteria:

- Emphasizing the market

structure by asset type;

- Defining the market structure

according to the type of lessor;

- Assessing the structure

according to the origin of the good financed;

- Characterizing the structure

relating to the type of user;

- Classifying the market

structure by contract term;

- Presentation of the structure

according to the type of financing.

All the criteria mentioned above allows for a clear view

upon the features and structure of the Romanian leasing market. The analysis is

made upon the results of the leasing industry at the end of 2008, considering

the national and international context, statistics provided by the Association

of Financial Companies - ALB Romania.

(Appendix 1.)

According to the type of good financed, the vehicles sector

accounts the most in the market structure, more precisely 71%, followed by

equipment leasing with 22%. The real estate leasing registers only 7%.

The largest share in the market structure by the type of

lessor is given by bank subsidiaries with 63%, followed by the captive sector

accounting for 19%. The lowest market share is held by the independent leasing

companies, although it is close to the one of captives, amounting 18%.

Approximately 59% of the goods financed are domestic good,

followed by the goods from the European Union accounting for 23% and leaving an

18% share of imported goods. A share of 89% of the customers is represented by

the corporate sector, 10% by the retail sector and only 1% accounts for the

public sector.

According to the contract term, 33% of the total amount of

contracts is concluded on a 4-5 year term, 28% on a 3-4 year term, 18% on a 2-3

year term and 13% on a period of time higher than 5 years. The contracts

concluded on a period shorter than 2 years accounts for only 8 % of the total

number of contracts.

As for equipment financing, 50% is related to

constructions, followed by a big fragmentation of small shares between several

industries, which have market shares between 3% and 5% such as: metal processing industry, food

industry, chemical industry, medical care equipment, printing and packaging

industry, wood processing industry. Only IT & Software accounts for 6%.

In terms of vehicles, 55% of them represent passenger cars,

followed by heavy commercials with 27%, light commercials - 15% and a 3% of

other vehicles.

The real estate financing sector is characterized by the

smallest share compared to the other two segments, from which 25% accounts for

office buildings and the same percentage for a special category of industrial

sale and lease-back real-estate financing, 19% land, 18% the residential

sector, followed by retail and outlets registering about 10% and the smallest

share is registered by hotels in terms of real-estate financing.

In 2009, after the first quarter, a change in the structure

of the leasing market is likely to occur. The share of equipment leasing is

increasing compared to the vehicle sector.

Because of the crash in car sales, the leasing companies

are heading themselves towards equipment leasing. The vehicle sector is diminishing

now in the leasing companies' portfolio, so the equipment sector is expected to

increase.

2. Major players

on the Romanian leasing market

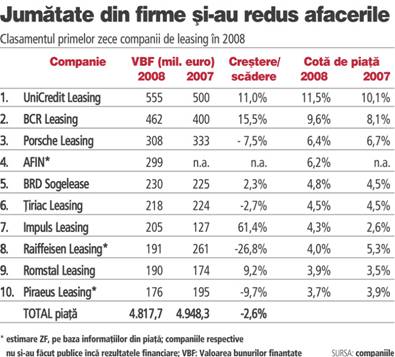

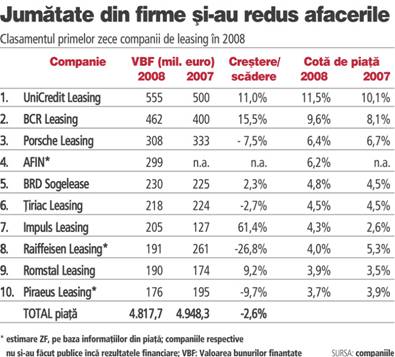

The leasing market has decreased from the beginning of 2008

for the first time in history after a continuous growth. The first three

companies on the leasing market are the same from 2007: UniCredit Leasing

Corporation (with a value of financed goods in 2008 of 555 mil. euros), BCR

Leasing (462 mil. euros) and Porsche

Leasing (308 mil. euros). On the forth place last year ranked Afin Leasing,

which according to the information on the market registered a value of financed

goods of 299 mil Euros. The company works closely with Cefin, authorized dealer

of the company Iveco for financing stocks. The fifth player on the market was BRD

Sogelease (with a value of goods financed of 230 mil. euro), followed by Tiriac

Leasing (218 mil. euro), Impuls Leasing (206 milioane de euro), Raiffeisen

Leasing (191 mil. euro), Romstal Leasing (190 mil. euro) and Piraeus Leasing

(176 mil. euro). OTP Leasing did not make it in the top 10, but it closely

follows Piraeus Leasing with 160 mil. Euros , value of goods financed .

Table 1. Top ten leasing companies of 2008

Source:www.zf.ro

Regarding

the no.1 player on the market, starting January 2007, the company

UniCredit Leasing Corporation IFN S.A.

has became the strong leader of the Romanian leasing market. Up to the present

moment, UniCredit Leasing has financed

projects from the most varied domains: vehicles (passenger cars and commercial

vehicles), constructions, transports, agriculture, the food and medical

industry, wood and metal processing, textiles and lether, real estates and

constructions, etc. With an expanding territorial network, which currently

includes 16 branches (Bacau, Baia-Mare, Brasov, Cluj-Napoca,

Constanta, Craiova, Galati, Iasi, Odorheiul Secuiesc, Oradea,

Pitesti, Ploiesti, Sibiu, Suceava, Targu-Mures and

Timisoara), UniCredit Leasing Corporation IFN S.A. provides its customers

with financing through contracts of financial and operational leasing, with an

average duration of 12 to 60 months, in the following domains: equipment

leasing, car leasing, real estate leasing, 'sale and lease back'

leasing and public leasing .

The second player on the market, BCR

LEASING IFN, a company member of the Banca Comerciala Romana Group,

offers a complete range of financial leasing services for purchasing durable

goods, i.e. automotives (automobiles, utility vehicles, fleets), equipment

(industrial machines, medical equipment, software and I.T., etc.), as well as

real estate leasing services for productive and commercial buildings.

BCR LEASING IFN has developed a large

national leasing network in Romania

and an important client portfolio from all activity sectors .

Porsche Leasing, the third player on the market is present

on the Romanian leasing market for approximately ten years. They financed so

far up to 88,000 vehicles and unlike the other two companies mentioned above,

they deal exclusively with vehicles.

All leasing

companies will see declines in 2009, because the market is significantly

affected by the collapse of new car sales, as well as by the lack of liquidity.

The decline is due to the economic crisis we have been experiencing since the

end of 2008. Following the lack of orders from clients, a lot of companies are

suffering from a shortage of liquidity. Most of the leasing companies

registered a decrease in the amount of financed goods, in the first quarter of

2009, such as Afin Leasing, the captive company of commercial vehicle importer

Iveco and number four on the Romanian leasing market, funded goods worth around

32.5 million euros in the first quarter of the year, down 38% against the first

quarter of 2008.

In the first three months of last year, the

value of financed goods amounted to 52 million euros. The company's business

has seen a decline due to the significant fall in truck sales, as a result of

the slowdown in the operations of construction companies and of transport

companies .

The same happened with Impuls

Leasing, the seventh player on the market who financed in the first three

months goods valuing 26 million Euros, decreasing 58% compared to the same

period in 2008 . This

happened mostly because of the vehicle sector, which accounts for almost 70%

from the businesses of leasing companies.

VB

Leasing, a company of the Austrian group Volksbank, stands in the same

situation as those mentioned above, with financed goods worth 12.7 million

euros in the first quarter of the year, down 70% against the same period of

2008.

Porsche

Leasing financed in the first four months of this year cars valuing 55 million

Euros, decreasing 45% compared to the same period of the last year. The market

decreased because of the fear that people have in making acquisitions, but the

market has, presently, a big chance of increase because of the deductibility of

the VAT, compared with the acquisitions made with cash. So, from this

perspective it will have an advantage.

Recently,

NBG Leasing, company controlled by the Greek group National Bank of Greece

financed in the first quarter goods valuing 30 mill. Euros dropping 47%

compared to the same period of last year. In the first three months the company

concluded almost 600 contracts. The representatives of NBG Leasing explained

the fall in the activity due to the company's strategy of minimizing risks. They

showed that the company reduced its activity in the fields that were most

affected by the crisis, respectively real estate and international

transportation. The company predicts for this year a turnover of

100 mil. Euros, declining 46% compared to the previous year, when they financed

goods valuing 185 mill. Euros.

Current trend of the Romanian

leasing market in the context of the financial crisis Due to the fact that

the vehicle sector accounts for the largest share on the Romanian leasing

market, I will focus my analysis especially on the vehicle sector of the

leasing market.

The number of clients who don't

manage to pay their installments increased in the first quarter of this year,

compared to the last quarter of 2008. Together with this, the number of the

cars put out for sale by the companies which financed them has also increased.

Different leasing companies have hundreds of cars that they are trying to

recover from the clients that didn't pay. For instance, BCR Leasing has almost

200 and Impuls Leasing has over 300. In terms of value, they exceed the value

of 1,000,000 Euros. Usually the financers start the enforcement procedure only

after the customer didn't pay for 3 consecutive months. The prices for the

recovered vehicles put out for sale are usually smaller than the sum that the

company has to recover.

The companies usually sell the

second-hand goods on loss, to recover at least part of the debt. Besides that,

recovering the goods means extra-costs for the leasing company, which, in most

of the cases is willing to provide for facilities to the clients, but not to

all of them. Although the number of users who no longer pay their installments

is increasing, the companies are cautious in negotiations with the clients .

For instance, the clients with

remaining debt are the last being taken into account at a negotiation table.

The newest solution is the one of reschedule and personalization of the facilities

given to the clients who can become solvable in a near future. Usually the

companies tend to avoid giving advantages in paying the installments to clients

who seem to have income problems in the future too.

Generally, when reselling an

automobile regained in possession, between 10% and 25% of the CIP price of that

good is being lost.

Raiffeisen

Leasing, the eighth largest player on the market at the end of last year, has

so far restructured almost 200 financing lines for clients who could no longer

pay their monthly installments. Around two thirds of Raiffeisen Leasing's

clients are small and medium-sized enterprises. The general manager, Mihaela

Mateescu says that in many cases companies in difficulty manage to resume installment

payment after the funding is restructured, which entails extending the maturity

or introducing a grace period. 'The debt collection department has doubled

its size in half a year, with the sales force providing additional help,

suggesting restructuring solutions to clients with problems', says

Mateescu. Currently, Raiffeisen Leasing has 10 employees who also deal with

repossessing goods. The company sealed 3,000 new contracts last year, with the

overall number of ongoing contracts reaching 12,500 at the end of 2008.

Porsche Leasing

is also recovering between 50 and 150 cars per month, but this is the last

solution. The rate of default which means a 60 days delay from the payment of

the installments increased from 0.8% last year to 1.5% this year. Before

beginning the enforcement the client can get a grace period or a reschedule.

On the

operational leasing segment, the company is doing well, because they recently

won an auction for renewing the auto park of the Romanian Post Office,

delivering 700 cars, the value of the contract being 22 mil. Euros.

There was news

that could have not passed unnoticed. Tiriac Leasing recovered from a client

that could no longer pay his installments a Rolls Royce Phantom Cabriolet, with

12,000 km. which they put out for sale with 349,000 euros (excluded VAT), 30%

cheaper than the catalog price.

The leasing

market depends a lot on the automobile market, which decreased by 60% and it is

natural that the leasing business is affected as well. In April, the leasing

share in the acquisition of new automobiles produced in Romania decreased with

6 pp compared with the same month in 2008, to 8% and for the import cars the

decline has been almost 7 pp, reaching 26%. So, from the total of 4,595 local

automobiles sold in April, exclusively Dacia,

8 % (345) were acquired through leasing, and the rest were bought in cash or by

credit. With respect to the import cars delivered in April, from a total of 10,289

units, 26% (2,655) were financed through leasing.

In terms of

recovering the goods from the clients who don't pay their installments it is

more difficult now for the companies to recover them after the Constitutional Court

changed the procedure of enforcement and introduced the obligation of obtaining

a judge's approval before starting the procedure.

Until this

change, the enforcement was made on the basis of the leasing contract. The

leasing companies claim that this will bring severe losses to them and the

enforcement procedure will last longer and it will be a more difficult and

complicated one. On the other hand, the lawyers claim that this gives a chance

for a fair trial, because the decision of enforcement will be given by a judge

who is impartial.

The change comes

in a period when the leasing companies are confronting themselves with an

increase number of bad clients and the request of enforcement brought before a

judge can last up to two months. In this period, the clients could even

fictively get rid of the goods. Automatically the provisions will increase and

the companies' profits will decline, and the money will remain stuck because of

the clients that didn't pay.

The beginning of

this was the decision of the Constitutional

Court concerning the fact that both parties have

the right to an equal and fair juridical treatment (in this case a fair trial).

The reasoning regarding this is given by the fact that the juridical enforcers

are not impartial because they are paid by the creditor. All enforcements

should be verified by a judge because otherwise, irreversible damage can be

caused.

Through this

change, the procedure returned to the one which was applied before 2006 and

which asked for a judge's approval. The effects of the decision of the Constitutional Court

can be disastrous because the losses of the leasing companies will be even

higher and the expenses with the provisions will also increase.

The need for the

leasing companies to sell their recovered cars enhanced the opportunity for new

businesses such as managing auto parks. For instance there is a company called

Car Logistics, that holds an auto park of 10,000 sm, and it has as clients BCR

Leasing and Uni Credit leasing. This new business could increase with several

percentages, but there is also a disadvantage. The cars of the leasing

companies can not stay in the parks forever. The bank subsidiary's leasing

companies are pressing them to sell the cars because they urgently need liquidities

and they set up targets. A good thing is that the majority of the people who

decide to purchase a recovered car usually pay in cash.

Because of the increase

in car recovery the advance in vehicle leasing increased from 5-15% to 20-30%,

as a mean of protection. The financers count on the fact that a higher amount

of advance will determine the clients to pay their installments on time because

if they don't, they will lose the advance and the installments paid up to the

moment of car return. There can also be some exceptions. If there is a client

with a good credit worthiness the leasing companies can drop the advance,

because it depends from case to case. The advance was increased due to the

higher risk that the companies face now.

This is not the

case for all the companies. For instance, Impuls Leasing did not change their crediting

policy, but they pay a lot of attention to the value of the good financed. If

the price of the car is very high, the advance will also be high. Another

method used besides increasing the advance is reducing the financing period.

TBI Leasing, for instance, started to finance mostly equipment, and the medium

financing period is of 3 years.

Some leasing

companies were capitalized by the shareholders in the last six months. The largest capital

increase was performed by Romstal Leasing, which ranked ninth last year on the

leasing market. Romstal Leasing is held by Belgian group KBC, which boosted the

company's capital by over 16.1 million euros in February this year.

Another

problem with which the leasing companies are confronting is fraud. Some clients

are intentionally damaging or setting the cars they bought in leasing on fire to

escape the burden of installments. The methods through which the customers that

can no longer pay their installments are very diversified. Among these, framing

accidents and thefts of the goods are more often met. Claims settled for car

insurance have soared this year, with one of the reasons being the rising

number of owners of cars acquired in leasing who are staging accidents to dodge

payment of installments.

The

sales representatives of Uni Credit Leasing Corporation claims that car theft

multiplied in the last period, especially the expensive cars to approximately

ten cases per month. In case of accidents, fires or thefts, the client can

receive a part of the sum paid by the insurer. In case of total damage, the leasing company

receives the payment from the insurer, it covers its own expenses and what is

left comes to the client. If so, the client has a potential earning if this

doesn't prove to be a fraud. In the opposite case, the insurer doesn't pay

anything and the leasing company has the right to sue the client in order to

recover its loss. Because of the increasing number of fraud, the insurance

companies consolidated their investigations department, but fraud is being

proven very difficult. The investigation usually lasts a month or two.

The future

perspective of the leasing companies depends a lot on their fight for survival.

The coordinates of the market changed dramatically. Now, it is about

consolidation and a clear and adequate selection of the clients that these

companies decide to serve. The fight for market share is not that important at

this stage, but risk management and cutting losses became primary objectives

now.

The rapid decrease in sales, generated by a decreasing demand, the

selectiveness toward the customers, the increase of risk provisions and

pressure on costs are now the main attributes of the Romanian leasing market.

I can say that

there are two severe effects of the crisis upon the leasing industry:

1. The massive

plunge in the automobile and truck leasing sector;

2. The slowdown

of the equipment market, especially constructions.

Leasing was a collateral victim that appeared

after the fall down of the real-estate market and automobile industry.

Current

tax treatment of leasing operations in Romania

A major fiscal advantage is represented by the

deductibility of the leasing installments. In the process of the legislative

track of the deductibility problem the following elements appeared:

- in the case of

operational leasing, the rent is totally deductible

- in the case of

financial leasing the beneficiary will deduce only the depreciation and the

interest.

The legislation

regarding the tax on profit had certain flaws regarding the deductibility of

the leasing interest, so from July 2002 from the implementation of the previous

law of the tax on profit

until February 2003, when modifications were made upon this normative act, the

practice of the financial leasing refrained significantly because of a low

level of deductibility of the leasing interests.

That law of

profit taxation introduced the taxation of the highest shares of interests from

different sources, the only exception being the bank interests. In case of

financial leasing the deductibility of the interest was limited to the level

Euribor or Libor plus 2 percentage points. The leasing companies couldn't

reduce the interest because of the high costs of contracting the bank loans so

as a consequence of the new taxation of profit; the cost of the leasing

installment for the financial leasing beneficiary was increasing by

approximately one third. It seems that through the respective law the MFP did

not want to affect the taxation of leasing. The reason invoked was the

limitation of the loans that the shareholders were given to the company, a

practice frequently in avoiding paying the taxes to the state. Due to the

misinterpretation of this law, it was modified in February 2003, and after that

maintained in the Fiscal Code.

A limited period

of time, the users of a good in a financial leasing regime had a series of

fiscal advantages specific to an investment in general such as:

- the decrease in the profit tax by 50% for

the part of the profit that was reinvested;

- for the small and medium enterprises, the

share of the gross profit that was reinvested was not submitted to taxation.

These facilities

given to the enterprises that were making investments were after that annulled

by the law that entered into force on the first of July 2002.

The fiscal

facilities given indirectly to the financial leasing lessee with a definitive

clause of ownership transfer stipulated in the new law of tax on profit are

less nuanced than the previous. Thus if they invest in fixed assets meant for

activities through which they are authorized and they didn't choose the

accelerated depreciation regime can deduce supplementary depreciation expenses representing

20% of the entry value of these. The remaining value to be recovered is

determined after the decrease in the entry value of the sum equal to the 20%

deduction. These provisions are taken over by the fiscal code that entered into

force in 2004. Another fiscal advantage that those who purchase a good in

financial leasing have is the fact that they can proceed to reevaluation of the

asset acquired in financial leasing.

Following this process the entry value of the asset will modify accordingly as

well as the depreciated value.

The payment of

the VAT in an echeloned way together with the payment of the leasing installments

also represents a fiscal advantage for the user.

Regarding the

VAT the interests related to the financial leasing do not enter in the taxation

basis of the VAT. This provision is well placed, given the fact that the

financial leasing is associated to a bank loan and the interest of the bank

loans is not submitted to this tax. This aspect can lean the decisional balance

towards one of the two categories of leasing. If we are taking into

consideration the operational leasing installment which is entirely submitted

to the calculation and payment of the VAT, in the conditions of a similar

financing method and forming of the leasing installments, practiced by many

Romanian leasing companies, this fiscal aspect becomes an element that favors

the orientation towards a certain type of leasing, the financial one.

Thus for the

leasing users juridical persons that are not VAT payers, by contracting an

operational leasing, the cost of leasing will be affected by the value of the

VAT applied to the entire leasing installment, while for the VAT payers this

fiscal factor appears only as a qualitative factor that can influence the

leasing decision concerning the blocking of the sum afferent to the VAT on a

limited period, until its recovery. Another fiscal advantage of operational

leasing was represented for a long period of time by the reduction in the

amortization period for the lessor. Until the 1st of January 2004

the lessor could deduce the value of the fixed asset except the residual value

on the duration contract but not less than 3 years. The fiscal code does not

stipulate, the deductibility of the amortization in the limits of the

provisions from law no.15/1994 regarding the amortization of the capital

immobilized in tangible and non-tangible assets, but the possibility of the

realization of an accelerated depreciation is kept with no special approval.

Another fiscal provision that influences the decision of the leasing companies

foreign juridical persons with the headquarter is the taxation at the source of

the income obtained by these under the form of interest (in the case of

financial leasing or royalty in case of operational leasing).

This fiscal

provision can constitute an advantage for the non-resident leasing companies

headquartered abroad in the case when the profit tax rate in the country where

it works is superior to the profit tax rate in Romania. According to the final

version of the Government Ordinance no 34 that modifies the Fiscal Code, it stipulates

that in the case of the cars with a weight under 5 tones with maximum nine

passenger seats and meant for person transport, the VAT will not be deductible,

except for those "used for transmission

of the usage within a financial leasing contract or an operational leasing

contract" .

In the case of

using a vehicle on the basis of a leasing company, the VAT related to the

installments is deductible, because according to the legislation leasing

represents a service, not a product.

According to the

Ordinance approved by the Government, the firms can deduce the VAT until 31 of

December 2010, but only for the cars used for certain activities, as taxi

services, delivery or driving school, but not for the vehicles meant for

exclusive transport of persons.

The VAT applied

to the leasing contracts for vehicle acquisition will still be deduced, but not

for the cars used in the personal interest of the managers. The acceptance of

the deductibility of the VAT for the cars purchased in leasing in the interest

of the company somehow saves the leasing market. There are also some issues

that still remain unclear regarding the tax treatment of the residual value.

For the cars purchased on the basis of a financial leasing contract, there are

some statements according to which the VAT is deductible for the advance and

for the installments, but not for the residual value. However, the concrete

acquisition of the good or the transfer of the ownership right takes place only

after the residual value is paid. In this case it could be considered that the

VAT could be deductible for the residual value too. The applying norms do not

clarify this and it leaves room for different interpretations.

Conclusions

Leasing as a

financing method has come a long way in its development throughout history in

terms of growth and financing of the economy, especially in some states where

the use of leasing creates certain facilities that favor the companies that

sustain the production, more than the consumption. This is not the case for Romania though, where the juridical

regalements were insufficiently encouraging for the beneficiaries of the

leasing operations. The decisional logic

which lies on the basis of leasing is the fact that property does not bring

profit, but the exploitation of it. The global leasing market proved itself to

be very dynamic starting from the eighties where its popularity became global,

registering a continuous increase in the number of leasing companies and the

volume of their operations.

This study was

accomplished starting from the premises that leasing is not just a method of

financing, but a way to enhance economic growth by stimulating investment. In

my paper, I coped with the main particularities of the leasing industry as well

as with the most recent statistics that concern the Romanian leasing market.

I presented in

the first chapter of my paper the main features of this financing method such

as the origin of lease financing and its development throughout history, the

clear distinction between the main types of leasing - financial and operational

- as well as the special forms of leasing, the arguments in favor and against

lease financing and the road that leasing has made starting from 1994 up to

2008.

From the

research made in chapter I, my conclusions are the following:

a leasing operation refers in

fact to a transmission of the right of using the good owned by a financer to a

user, against a periodical payment and at the end of the leasing period the

user can choose between buying the good, extending the leasing agreement or

ending the contract;

leasing has had a high dynamics

starting from 1952 when the "United States Leasing Corporation" was created, rapidly expanding globally;

the financial leasing is more

popular than the operational leasing, the latest being generally quite

expensive;

although there are more

advantages of leasing than disadvantages, the decision of financing through

leasing has to be fundamented on behalf of both of the parties by the obtaining

of the maximum advantages;

in terms of volumes, both in

Europe and Romania,

the vehicle sector accounted the most and the dominance of bank subsidiaries as

players increased on the European and

Romanian market in the past few years,

while the number of independent players declined.

Chapter II

presented the way leasing operations are carried out: the characteristics and

features of a leasing contract, the way that leasing operations are registered

in the accounting of both parties, the way leasing installments are being

calculated and the types of risks that both parties assume when involving in a

leasing operation. The study of the implementation of leasing operations led me

to the following conclusions:

the leasing contract is an

atypical contract situated somewhere between renting, buying and crediting, but

not a combination of those contracts;

in the purpose of eliminating the

tendency of not offering a clear image upon the activity of the company

reflected in the annual statements, the International Accounting Standards must

be adopted more rapidly;

the quantum of the leasing

installments represents a key element of any leasing operation, because for the

leasing company the recovery of the investment made in the leased good is

accomplished through the leasing installments and the residual value (financial

leasing), while for the beneficiary it represents a monthly expense that has to

be covered from the profit resulted from exploiting the good;

risks must be identified and

evaluated in order to control them and to minimize them;

the research made confirm that

leasing is a financing activity with relatively low risk, but still, an

efficient management of risk is an important factor for a good -performing leasing company;

The case study

that I have chosen for chapter III is meant to create an overall picture of the

Romanian leasing market and the impact that the financial crisis has had upon

it. The elements that I took into account are: the way the market is structured

nowadays, the players on the market and the way the latest events have

influenced their activity, the current situation which the leasing companies

are facing and with what problems they are confronting now, as well as the

issues regarding taxation with the latest completions. After the analysis made

in chapter III, I conclude the following:

most of the leasing companies

registered a decline in the amount of goods financed in the first quarter of

2009, the market being seriously affected by the collapse of new cars sales;

the number of clients that no

longer pay their installments increased significantly in the first quarter of

this year;

the number of recovered cars is

growing rapidly, although it is the last solution. Due to this fact, the debt

collection departments of leasing companies increased the number of employees;

the leasing companies usually

sell the second-hand goods on loss, to recover at least part of the debt;

the Constitutional Court changed the

procedure of enforcement and introduced the compulsory of obtaining a judge's

approval before starting the procedure and this can increase the losses for the

leasing companies;

Government Ordinance no. 34

introduced some unclear issues regarding the tax treatment of the residual

value. The applying norms do not clarify whether or not the VAT is deductible

for the residual value as well;

leasing is a collateral victim

that appeared after the fall-down of the real-estate market and automobile

industry.

Finally, I would

like to conclude the fact that the analysis from the final chapter represents a

study that intends to emphasize a series of problems of actuality and

perspective regarding the Romanian leasing market. The research made for this

paper allowed me to discover many aspects concerning this method of financing

which I found very useful for the future.

References

Achim

M., Leasingul-o afacere de success,

Ed. Economica, Bucuresti, 2005.

Andreica

M., Andreica C., Mustea-Serban I.,Mustea-Serban R., Decizia

de finantare in leasing, Ed. Cibernetica MC, Bucuresti, 200

Aristotle

- Retorica, Book 1, chapter 5.

Belu

Magdo M.L, Contracte comerciale

traditionale moderne, Ed. Tribuna Economica, Bucuresti, 1996.

Boobyer

Chris, Leasing and finance assets-4th

edition, Euromoney Books, UK, London,

2003

Brayshaw

R.E., Wilkers F.M., Samuels J.M., Management

of company finance - sixth edition, Ed. Chapman&Hall, 1995.

Brigham

E, Ehrhardt M., Gapensky L., Financial

management, theory and practice, Ed. The Dryden press, 1999.

Caras

Mircea, Leasing, Ed. Enciclopedica,

Bucuresti, 1986.

Clocotici

D., Gheorghiu Gh., Operatiunile de

leasing, Ed. Lumina Lex, Bucuresti, 2000.

Constantinescu

Coca C., Leasing financiar, realitate si

perspectiva, Ed. Economica, Bucuresti, 2006.

Dodds

C., Punty A., Financial management,

method and meaning, Ed. Chapman&Hall, 1991.

Giovanolli

M., Le credit-bail(leasing) en Europe.

Developement et nature juridique, Paris,

1980.

Guresoaie I., Contractul

de leasing - documentare si prezentare, Ed. Gricom Service, Bucuresti,

1998.

Jaffe

F.J., Ross A.S., Westerfield R.W., Corporate

finance, third edition, SUA, 199

Kolari

J., Rose P., Financial Institutions, Ed. Erwin, U.S.A., 1995.

Molico

T., Wunder E., Leasingul, un instrument

modern de finantare, Ed. CECCAR, Bucuresti, 200

Negrus

M, Finantarea schimburilor

internationale. Politici. Tehnici., Ed. Humanitas, Bucuresti, 1991.

Puiu

A., Tehnici de negociere contractuala si

derularea in afacerile economice internationale, Ed. Tribuna Economica,

Bucuresti, 1997.

Van

Horne J., Wachowicz jr. J., Fundamentals

of financial management, Ed. Prentice-Hall Inc., 1992.

Articles :

Chivu L., Raiffeisen Leasing si-a dublat departamentul de recuperari, 20.05.2009, https://www.zf.ro/banci-si-asigurari/raiffeisen-leasing-si-a-dublat-departamentul-de-recuperari-4417170/.

Dumitru P., Stavrache G., Pierderi si migrene pentru

companiile de leasing, 19.05.2009, https://www.moneyexpress.ro/articol_17787/pierderi_si_migrene_pentru_companiile_de_leasing.html.

Hasnas T., Operatiunile de leasing si contabilizarea lor, Revista "Tribuna

Economica", nr. 35/1998 .

Mediafax, Finantarile NBG Leasing au scazut cu 47% pana la 30 milioane euro, 09.06.2009, https://www.zf.ro/banci-si-asigurari/finantarile-nbg-leasing-au-scazut-cu-47-pana-la-30-de-milioane-de-euro-4502965/.

Mediafax, 3000 de contracte pentru companiile de leasing auto in aprilie, 21.05.2009,

https://www.zf.ro/eveniment/3-000-de-contracte-pentru-companiile-de-leasing-auto-in-aprilie-4428682/

.

Placinta A., Proprietarii de masini in leasing isi insceneaza accidente,14.06.2009,

https://www.zf.ro/banci-si-asigurari/proprietarii-de-masini-in-leasing-isi-insceneaza-accidente-4550892/

.

Placinta A., Topul primelor zece companii de leasing, 20.02009, https://www.zf.ro/topurile-zf/topul-primelor-zece-companii-de-leasing-4063846

.

Placinta A., Afin Leasing financing down 38%, 105.2009, https://www.zf.ro/zf-english/afin-leasing-financing-down-38-4359827/

.

Placinta A., Impuls leasing: masinile recuperate de la clienti ar putea fi

exportate, 04.05.2009, https://www.zf.ro/banci-si-asigurari/impuls-leasing-masinile-recuperate-de-la-clienti-ar-putea-fi-exportate-4282730/.

Raduta A., Lupta companiilor de leasing pentru supravietuire, 27.04.2009, https://www.businessmagazin.ro/analize/servicii-financiare/lupta-companiilor-de-leasing-pentru-supravietuire-4245895.

Stergarescu C., Firmele de leasing au pe lista recuperari de milioane de euro,

29.04.2009, https://www.capital.ro/articol/firmele-de-leasing-au-pe-lista-recuperari-de-milioane-de-euro-118997.html.

Legislation :

Government ordinance no.51/1997

approved and modified by article VII of

Law No. 99/1999 Concerning some measures to accelerate the economic reform.

Ordin nr. 1752/2005 for approving the

accounting treatment according to the European Directives, art. 38, alin. 2.

The Fiscal Code from 22.12.2003,

published in the M.O. nr. 927/212.2003, approved by the law nr. 571/22.12.2003,

published in M.O. nr. 927/212.2003, art. 135.

Law no.414/26.06.2002, regarding the

tax on profit published in the M.O. no.456/27.06.2002 abrogated through the

Fiscal Code.

The norm regarding the reevaluation

of fixed assets from 18.12.2003 published in M.O. no.21/12.01.2004, art.2 ,

lit. F.

OG no. 34/11.04.2009, regarding the

budgetary rectification on 2009, published in MO no. 249/14.04.2009.

Websites :

www.unicreditleasing.ro

www.bcr.ro/leasingro

www.porschebank.ro

www.alb-leasing.ro

www.leaseurope.org

www.zf.ro

www.capital.ro

www.moneyexpress.ro

www.businessmagazin.ro